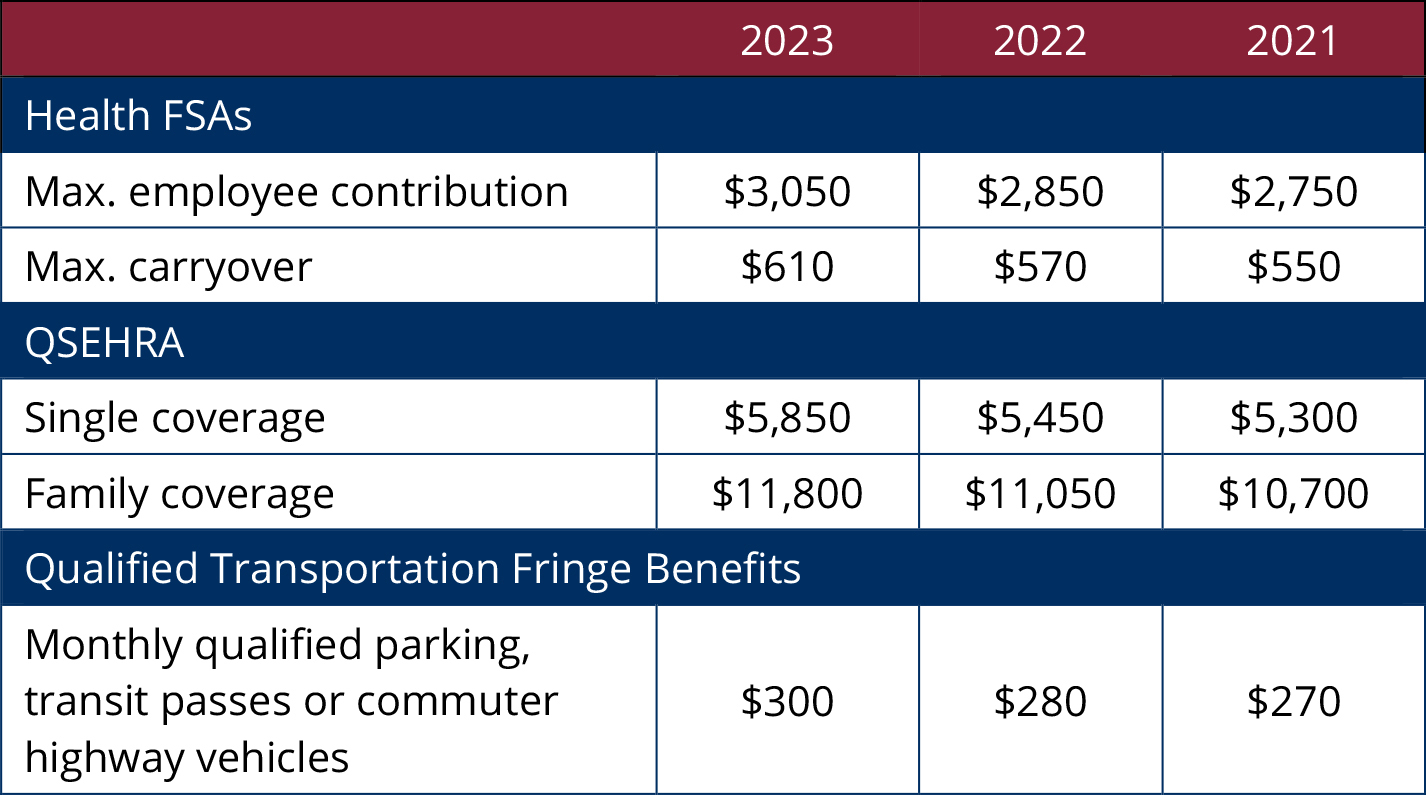

Fsa Income Limits 2025 - 2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide], The amount of money employees could carry over to the next calendar year was limited to $550. Health fsa contribution and carryover for 2025. 11+ Dependent Care Fsa Limit 2023 Article 2023 VJK, Increases to $3,200 in 2025 (up $150 from $3,050 in 2023) fsa carryover limit: The top rate of 37% will apply to individuals making above.

2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide], The amount of money employees could carry over to the next calendar year was limited to $550. Health fsa contribution and carryover for 2025.

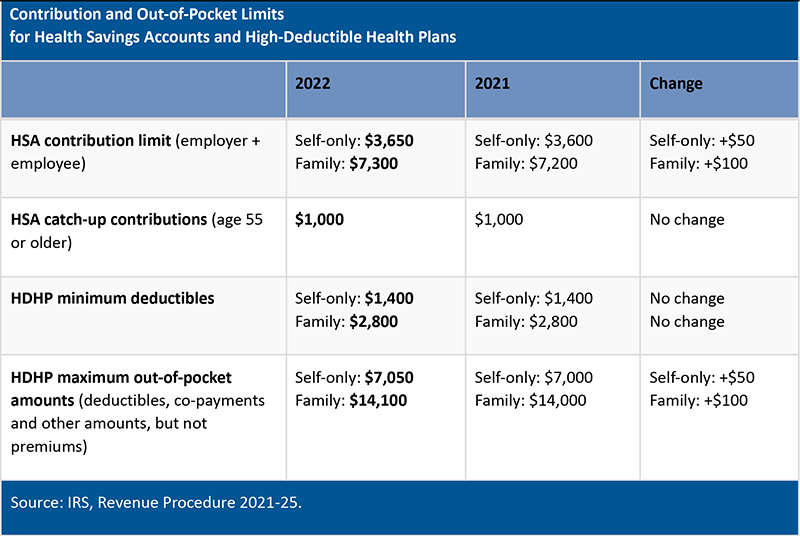

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, New fsa and hsa limits. While there are no income limits for the fafsa, your family's income does affect your financial aid eligibility.

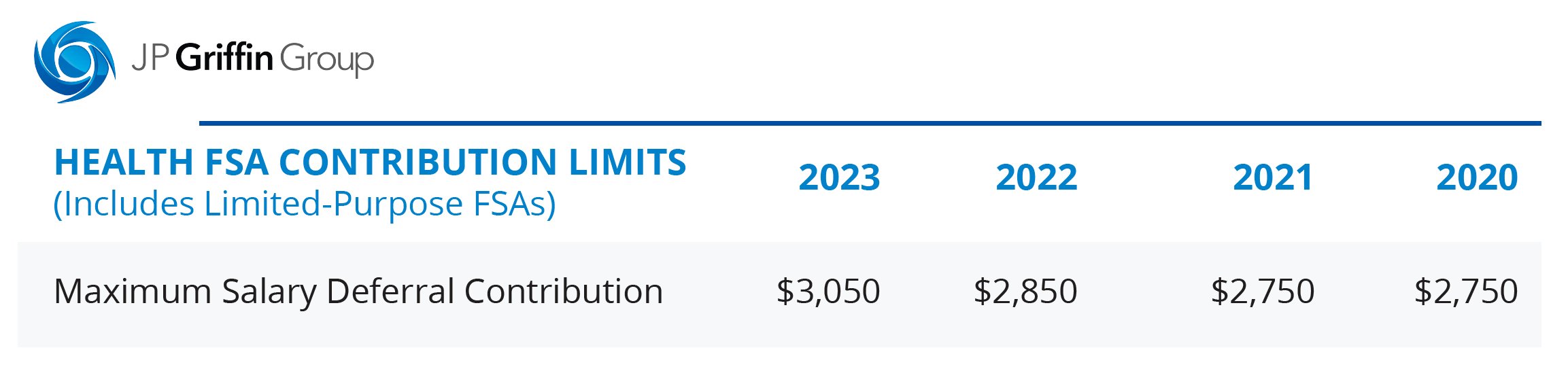

Irs 2025 Fsa Limits, But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). The fsa contribution limits increased from 2023 to 2025.

2023 FSA limits, commuter limits, and more are now available WEX Inc., Carryovers allow you to spend a maximum of $610 of unused healthcare. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Health FSA Contribution Max Jumps 200 in 2023 MedBen, See what types of aid you you may qualify for. For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint filers up to $23,200.

The irs has recently disclosed adjustments to contribution limits for 2025, bringing some changes to both fsas and hsas.

But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

The top rate of 37% will apply to individuals making above. For plans that include the carryover option, that.

Irs 2025 Fsa Limits, If you don’t use all the funds in your account, you may. Check out the shrm legalnetwork.

Fsa Income Limits 2025. For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint filers up to $23,200. The annual contribution limit for fsas has been raised to $3,200, compared to $3,050 in 2023.